Before you move home it’s important to carry out a property valuation. An online property valuation will give you an estimate of how much your home is worth in the current market. This works by websites comparing sold prices from land registry, properties currently on the market and national index data.

An online property valuation is a great way to get a quick and easy estimate of your properties valuation. There’s no need to pay for a home buyers report or speak to any estate agents.

By answering a few questions our software will search millions of records to return a free valuation and confidence score.

Once we generate your house valuation we will also search 100’s of national buyers who seek property in your area. Just like a comparison site, we help you compare property buyers who are pre-vetted by us.

Our service is free of charge and you are under no obligations. Over 30,000 customers a year save thousands in estate agency fees by selling direct.

If you’re wondering how much your property is worth, it’s important to understand how a properties valuation is calculated by Estate Agents, Mortgage Companies and websites like ours.

In simple terms a properties value is the price that someone is prepared to pay on the open market. However, unlike small transactions such as household goods, properties tend not to change hands often. So there are actually 100’s of factors which can affect how much a house or flat might be worth.

Recent sold properties on your street, properties currently on the market, local area information, market trends and even external factors such as international financial market – casepoint the 2008 financial downturn and property values knock on effect.

With all this in mind we want to show you how to achieve an accurate property valuation. Using either our free tool, or other calculators available online, let get started!

Similar to Rightmove and Zoopla, our software pulls local sold prices in your area and then applies the historical price changes automatically to create an property valuation data point. We then take data from the main property portals and see how closely the asking prices of properties in your area match the sold price data.

We are then able to delivery you a free home valuation including a confidence score.

Whilst this is still in beta mode the more valuations we carry out the larger our data becomes which is why we believe we will hold the most accurate property valuation data in the UK.

We also estimate based on demand how much you are likely to sell your house through the various options available.

Please feel free to try our calculator now or read more on our site about the different ways you can sell your house.

If you want to value your property online then it is important to learn how to use all the latest online valuation tools.

This guide will give you the step by step process to help you find out how much a property is worth before deciding to sell or buy.

Property portals are a great because they display actual properties currently on the market which you can use to compare with your own. The main two portals are RightMove and Zoopla; who between them have over 10 million of properties for sale or to rent.

There are several ways you can use these portal to value your home so let’s review each one here:

Rightmove is the UK’s largest property portal and receives an estimated 100m visits every month from potential property buyers and vendors looking to sell their home. Most major estate agents list property with them but they also have a couple of great tools you can use to value your property for free online.

We will be using 3 Rightmove resources to value a property in this tutorial.

The Rightmove House Price Index tracks home values across the United Kingdom by collecting data from land registry on properties sold nationwide.

The Rightmove for Sale data is simply using their portal to see which properties are currently on the market for sale, how much the asking price is and what’s ‘sold under contract’. it’s very handy if there are recently sold properties in the area.

Because rightmove is the biggest property portal, with over 19,000 Estate Agency listing properties, you have the best chance of finding good comparable results.

Rightmove Market Trends is a tool which looks at historical sold prices in an area over a period of time and compiles this data into a valuation trend graph which we can use to estimate a value of a property sold several years ago.

Test case property:

We used this data to estimate this properties value using the free Rightmove valuation tools.

We found the property price index and for sale results were not the most accurate way to value a property, however it was useful in giving a rough guide to how much real property in the area might be worth. By reviewing properties for sale in your area alongside recent market trends you should get a good idea on the potential valuation.

Remember not to confuse the Sold House Prices section of the website with the Rightmove Property Valuation section – which will not give you an online property valuation, but rather pass your details onto local estate agents who are paid members of their service.

As subscription based valuation tool, it is normally used by Estate Agents and property professionals to gain greater insight into a property along with information on local and national trends.

Rightmove Plus is not generally open for public use, however Estate Agents can create very detailed and branded valuation report to show potential clients – you might be able to get your hands on a free report by asking your local estate agent.

Not far behind Rightmove in terms of market share is Zoopla, which is another large property portal services the UK market. Zoopla claims to have the most accurate valuation tools but after testing we found them similar in terms of results to Rightmove and other options.

There are three main Zoopla resources which you can use for free:

The Zoopla house prices and values tool works by collecting data from land registry and overlaying information from their large database of estate agent members and website visitors. By combining this information, they are able to predict how much a property might be worth and apply their own Zoopla Zed-Index estimate.

The Automated Personal Valuation still used the Zed-Index data but applies some additional filters. The tool asks you questions such as property condition, number of bathrooms, etc to apply addition value if the property is above average condition.

Zoopla properties for sale returns all the properties available for sale in each postcode area. This is supplied from their estate agent members who upload properties daily.

The Land Registry is a government agency which stores every property sold in the United Kingdom. If fact it’s the law that Solicitors must register the property transaction within 30 days.

Sold house prices on your street therefore make a great way to help determine a real property value. It tells us what someone was actually prepared for a property – which is a much better indication of value than Estate Agency listing.

Like Zoopla and Rightmove, many sites use sold house price data from Land Registry – including ours of course 🙂

Here are some of our favourite sold house price websites.

Probably one of the first websites which took land registry sold price data and presented it for free to consumers. Mouse Price delivers data quickly and in a clear format. They have recently started giving estimate valuation to member’s using local market trend API’s which is like how we work.

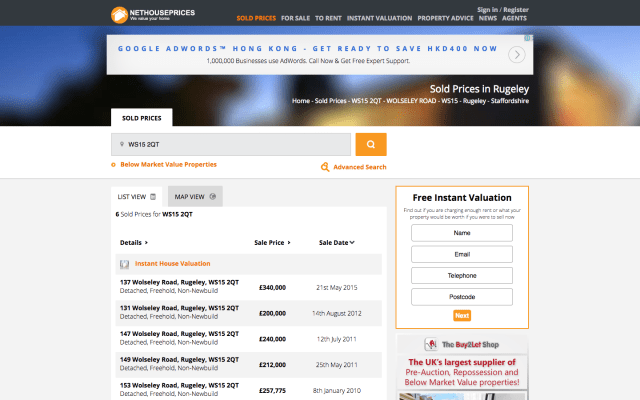

This website compiles the data from the same source as everyone else. We like the local property sold prices from NetHousePrices.com because they deliver them in a very simple and clear format.

As the largest residential mortgage lender in the United Kingdom – they have been lending to homebuyers for over 60 years! This means they have a lot of housing data from decades of lending.

They produce a monthly house price report which uses all it’s mortgage lending data to show how much people are paying for property and how much they are worth based on RICS’s valuations. This results in a monthly % change and can be tracked over long periods of time.

The Nationwide House Price Calculator is a neat little tool which you can use alongside sold prices in your area.

Enter the sold price into the ‘property valuation’ field and the date sold into the ‘Valuation year 1’. Choose the property region and hit calculate. This will then apply the monthly regional price changes to the historic sold price and return a valuation.

In our example, we used the sold price of £235,995 which was in Q2 2006. Nationwide House Price Valuation returned £263,795, which is very similar the results from other tools.

Delivered by the Land Registry, the HPI uses recently sold prices and compares them to historical sold data. This is used to calculate the percentage difference.

Because it comes direct from an independant agency, it’s one of most trusted indexes available . You can access the monthly reports here.

Many economists and the media use this index to predict the current and future health of the housing market.

You can use the index in the same way as the nationwide house price index. However, due it is being raw data, you’ll need to apply the compounded monthly changes in your area by yourself.

We hope you found our guide useful. Overall it’s pretty easy in todays age to get accurate data allowing you to get a rough idea about your homes valuation. Whilst it will never be more accurate that paying for a RICS valuation it certainly gives you a good benchmark.

If you’re ready to use our calculator please just click the button below. The process only takes around 1 minute and you’ll have a free report to help you determine the properties value.

I was looking to sell my mother’s home after her going into long term care. It was a difficult time but the company was really sympathetic. They get buyers to bid against each other, getting you the highest offer. I recommend their service to anyone looking to sell without an estate agent.

Mrs Morris, Cardiff Rating 8.7/10